Welcome to the Plaid Policy Pulse. In this quarterly series, we provide our perspective on public policy developments impacting consumers' access to their data.

The Big Idea 💡

As financial services goes digital around the globe, it’s important for the innovative companies driving that change to make their voices heard.

Here, we highlight opportunities to engage with regulators and industry groups on important policy developments around the world:

- Open banking on a global stage

- Fintech gaining regulatory foothold in US

- States embrace fintech and consumer protections

Open banking on a global stage 🌎

Consumer demand and government mandates are opening up the global banking sector.

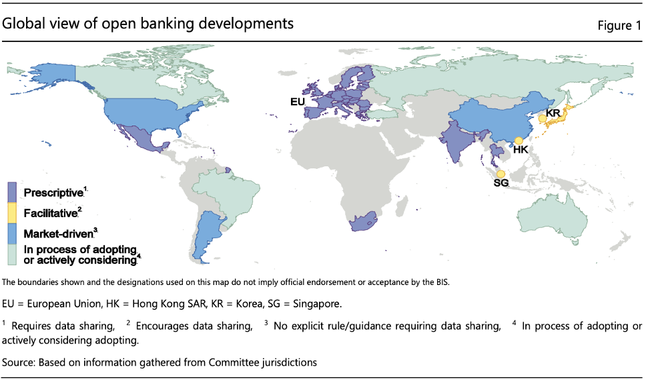

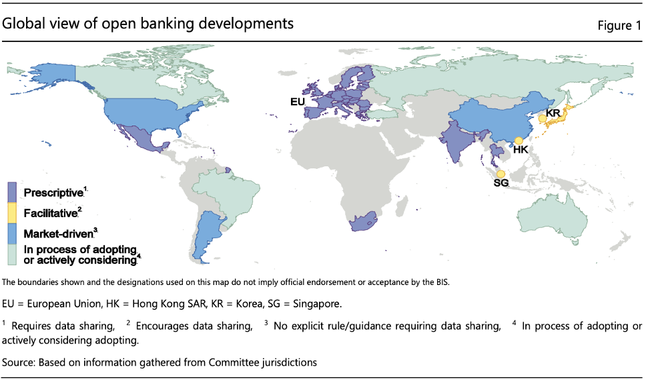

But we’re still seeing a variety of approaches to structuring open banking systems, with differing outcomes for participating fintech companies and consumers.

(Map from the Basel Committee's Report on open banking and application programming interfaces (APIs))

EU: Implementation challenges, licensing issues and limited data field availability under PSD2 present challenges to open banking’s growth. Still, demand is growing.

UK: The Financial Conduct Authority (FCA) wants to explore expanding open banking to Open Finance, which would include access to more account types.

Canada: Canada’s government is moving towards open banking, calling it “Consumer-Directed Finance,” and hoping to adopt the best of other jurisdictions' policies.

Australia: Australia’s Consumer Data Right (CDF) is the world’s most expansive rights-based regulation, but implementation delays have pushed back launch, and regulators are exploring whether intermediaries have a role to play in this system.

Singapore: Singapore released a strategy book to help banks launch API technology, aiming for an “organic,” market-driven approach.

Mexico: In a country in which only 37% of citizens have a bank account, the government launched a FinTech Law that covers open banking, cryptocurrencies, payments, and more.

US: Regulators are exploring ways to enforce consumer data rights; industry groups are pressing for standardization; and major institutions are stepping in with their own suggestions.

⭐️ Our takeaway: Decisions are being made now, and financial service laws generally don’t change fast once they are in place. Fortunately, opportunities exist to add your voice to the discussion:

Finance Canada will be holding working groups to explore structures for Consumer-Directed Finance over 2020. UK’s Open Finance consultations are an opportunity for non-payment fintechs (like loan repayment, mortgage, pension, etc.) to get access to critical data fields. US regulators, including the CFPB and Federal Reserve are continuing to hold office hours to communicate with fintech companies. Reach out if you’re interested in periodic updates or for opportunities to contribute on any of the above.

Three key advancements show how fintech is gaining ground in the US regulatory ecosystem:

- The OCC updates its Third-Party Guidance.

- Varo obtains an FDIC charter.

- LendingClub purchases Radius Bank.

OCC updates: The Office of the Comptroller of the Currency updated its guidance to banks on Third-Party Relationships to focus on fintech and aggregators. For the first time, these FAQs include guidance on how banks should manage aggregator relationships, as well as the implications of direct fintech-bank relationships. The OCC makes clear that it expects OCC-supervised banks to do due diligence on aggregators or any party that chooses to directly access consumer data from a bank.

Varo and Lending Club: Meanwhile, Varo Money and Lending Club became the first two fintech companies to obtain their own federal banking charters, allowing them to expand nationally and offer deposit insurance without relying on bank partners.

Varo is set to become the first fintech bank to receive its own FDIC charter. Lending Club took a different approach to obtaining federal charter by acquiring Radius Bank.

⭐️ Our takeaway: Varo and Lending Club invested early in regulatory relationships, and those strong relationships positioned them well for these approvals. We expect the line-blurring between “bank” and “fintech” to continue, with regulators regularly adding clarity to how they, and the banks they oversee, should work with fintechs. And expect more developments to bring fintech banks into the mainstream.

States embrace fintech & consumer protection 👐

In recent months, both New York and California have announced intentions to stand up state-level consumer financial protection agencies, citing a less aggressive CFPB as a motivating factor.

New York’s Department of Financial Services (NYDFS) is expanding its supervisory powers to include securities, cryptocurrencies, and merchant cash-advances. California is expanding its powers to cover debt collectors and unfair and deceptive acts and practices.

Importantly, both offices plan to focus on fintech as a source of innovation, with the NYDFS opening an Office of Innovation, and California standing up an Office of Financial Technology Innovation based in SF to create space for fintechs to work with regulators.

⭐️ Our takeaway: Think about how to engage with these new offices. It’s a critical time for fintech companies to talk with regulators, and these new offices create excellent opportunities for fintech companies to get feedback and input on their products and strategy.

Ben White works on Policy R&D at Plaid. He's passionate about building a financial services system that benefits everyone.